Mortgage calculator paying additional principal

Use our mortgage calculator to estimate your monthly house payment including principal and interest property taxes and insurance. This portion goes toward paying down your mortgage balancethe original amount you borrowed.

Mortgage Calculator With Extra Payments Top Sellers 50 Off Www Wtashows Com

Use this additional payment calculator to determine the payment or loan amount for different payment frequencies.

. Mortgage payment The monthly mortgage payment is calculated based on the inputs you provided. This goes into a holding fund an escrow account that your lender or mortgage servicer uses to pay your property taxes and homeowners insurance. Most people need a mortgage to finance a home purchase.

Your mortgage principal is the mortgage amount you borrowed to buy your home minus what youve already paid back through monthly or bi-weekly payments. Of course thats just a ballpark estimate. A higher principal balance means that youll be paying more mortgage interest compared to a lower principal.

Plus the more additional principal you pay the less interest youll pay over the life of the loan. This is the best option if you are in a rush andor only plan on using the calculator today. Youll need to know your principal mortgage amount annual or monthly interest rate and loan term.

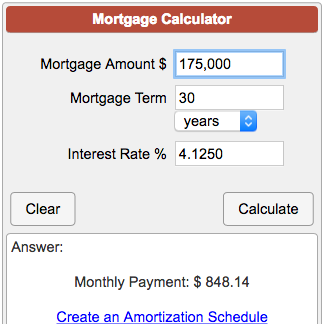

In just 4 simple steps this free mortgage calculator will show you your monthly mortgage payment and produce a complete payment-by-payment mortgage amortization schedule. This is the best option if you plan on using the calculator many times over the. The mortgage amount rate type fixed or variable term amortization period and payment frequency.

This early payoff calculator will also show you how much you can save in interest by making larger mortgage payments. Make payments weekly biweekly semimonthly monthly bimonthly quarterly or. You can calculate a monthly mortgage payment by hand but its easier to use an online calculator.

The amount of interest that you pay will depend on your principal balance. Mortgage Calculator exe file - click the link and immediately run the mortgage calculator. Additional mortgage payments have the greatest effect when you apply them early.

Of course paying additional principal does in fact save money since youd effectively shorten the loan term and stop making payments sooner than if you were to make the minimum payment. Your mortgage principal balance is the amount that you still owe and will need to pay back. With several primary inputs as well as additional advanced fields that account for PMI homeowners insurance zip codeproperty taxes and homeowner association fees Guaranteed Rates home mortgage calculator incorporates almost every conceivable variable that could affect your mortgage costsThe result is an estimate of future monthly mortgage payments that you.

Since your principal is largest during this time it generates high interest charges. If you make extra payments at the beginning of your mortgage this significantly diminishes the principal. Check out the webs best free mortgage calculator to save money on your home loan today.

Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules. Mortgage interest is amortized so that you pay the bulk of your interest in the first years of your mortgage. Mortgage calculator - calculate payments see amortization and compare loans.

Any extra payments will decrease the loan balance thereby decreasing interest and allowing the borrower to pay off the loan earlier in the long run. Our calculator includes amoritization tables bi-weekly savings. Thats because any interest owing is paid first.

However that only happens after a certain. Some people form the habit of paying extra every month while others pay extra whenever they. Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculatorWhen you pay extra on your principal balance you reduce the amount of your loan and save money on interest.

On typical long-term mortgage loans a very big portion of the earlier payments will go towards paying down interest rather than the principal. This is another reason why lenders discourage extra payments for the first 3 years of a loan. So if youre currently paying 1000 per month in principal and interest payments youd have to pay roughly 1500 per month to cut your loan term in half.

To get serious about paying off your mortgage faster here are some ideas to help. Our mortgage payoff calculator can show you how making an extra house payment 1050 every quarter will get your mortgage paid off 11 years early and save you more than. Make Extra House Payments.

Mortgage Calculator zip file - download the zip file extract it and install it on your computer. This portion goes into the lenders pocketIts their fee for lending you the money. A portion of each payment will go toward paying this off so the number will go down as you make monthly payments.

Additional payments to the principal just help to shorten the length of the loan since your payment is fixed. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more. Keep in mind that you may pay for other costs in your monthly payment such as homeowners insurance property taxes and private mortgage insurance PMI.

Lets say you have a 220000 30-year mortgage with a 4 interest rate. A general affordability rule as outlined by the Canada Mortgage and Housing Corporation is that your monthly housing costs should not exceed 32 of your gross. The good news is as you continue to.

As you make mortgage payments your principal balance will decrease. Remember however that the full amount of those mortgage payments doesnt go toward paying down your mortgage principal. If youre thinking of refinancing your mortgage.

You can also see the savings from prepaying your mortgage using 3 different methods. Principal is the amount of money you borrowed on the mortgage. It will depend on the mortgage rate and the loan balance.

If you start paying additional principal youll save a lot of money in interest.

Mortgage Calculator With Extra Payments Sale 53 Off Www Wtashows Com

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Mortgage Calculator With Extra Payments Clearance 53 Off Www Wtashows Com

Mortgage Interest Payment Calculator Sale Online 57 Off Www Ingeniovirtual Com

Extra Payment Calculator Is It The Right Thing To Do

Extra Payment Calculator Is It The Right Thing To Do

Mortgage With Extra Payments Calculator

Loan Amortization With Extra Principal Payments Using Microsoft Excel Amortization Schedule Mortgage Amortization Calculator Money Management Advice

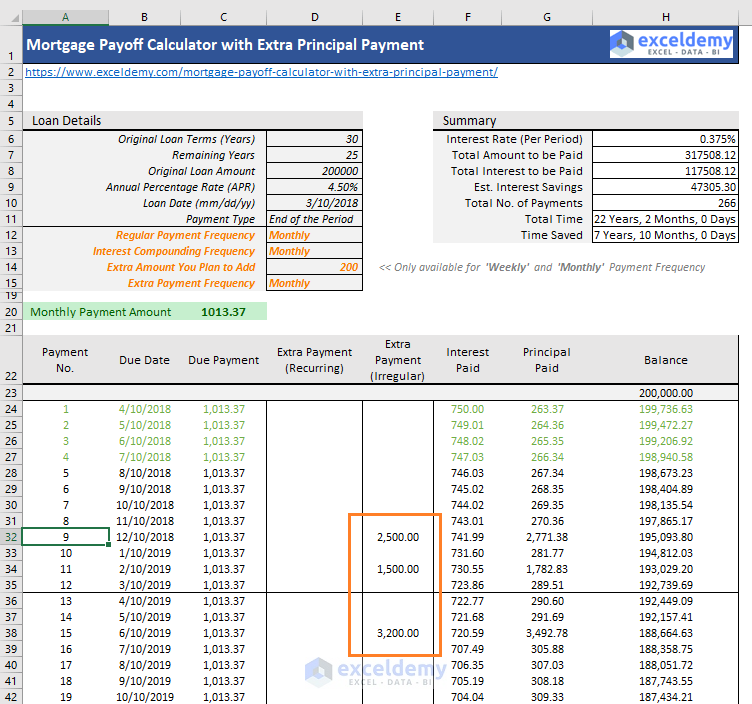

Mortgage Payoff Calculator With Extra Principal Payment Free Template

Mortgage Interest Payment Calculator Sale Online 57 Off Www Ingeniovirtual Com

Housing Loan Interest Calculator Sale 57 Off Www Ingeniovirtual Com

Early Mortgage Payoff Calculator Mls Mortgage Amortization Schedule Mortgage Refinance Calculator Mortgage Payoff

Loan Repayment Calculator

Mortgage Interest Payment Calculator Sale Online 57 Off Www Ingeniovirtual Com

Mortgage Payoff Calculator With Extra Principal Payment Free Template

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com

Mortgage Calculator With Extra Payments And Lump Sum Excel Template